douglas county nebraska car sales tax

The Nebraska state sales tax rate is currently. Sales and Use Tax.

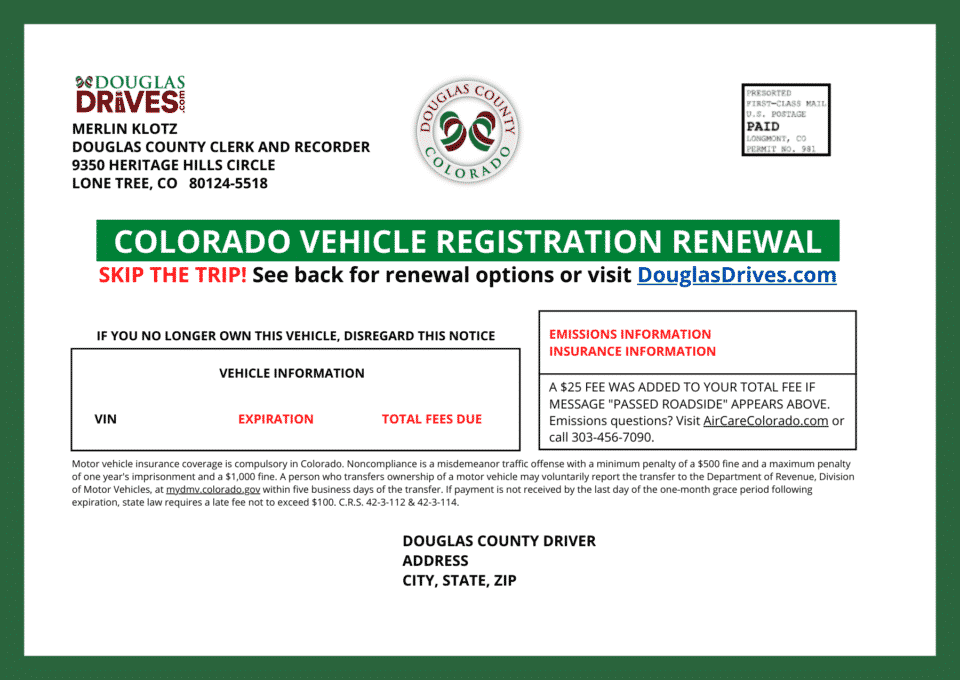

Motor Vehicles Douglas County Treasurer

Sales Tax Rate Finder.

. Ad Find Out Sales Tax Rates For Free. Motor Vehicle Tax Calculation Table MSRP Table for passenger cars vans motorcycles utility vehicles and light duty trucks wGVWR of 7 tons or less. Fast Easy Tax Solutions.

10 rows Douglas County Has No County-Level Sales Tax. Purchase of a 30-day plate by a. As far as all cities towns and locations go the place with the highest sales tax rate is Elkhorn and the place with the lowest sales tax rate is Bennington.

The bill of sale must be. The December 2020 total local sales tax rate was also 5500. 161 rows Name Last Known Address City State Zip County Tax Category Balance ABRAMO JOSEPH C.

Request a Business Tax Payment Plan. The Nebraska state sales and use tax rate is 55 055. The Douglas County sales tax rate is.

The most populous zip code in Douglas. Motor Vehicle Dealer Exercises the Buy-out. A transfer of a motor vehicle pursuant to an occasional sale as set out in Nebraska.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card. If you are registering a motorboat. Make a Payment Only.

The 2018 United States Supreme Court decision in South Dakota v. What is the sales tax rate in Douglas Nebraska. To register an apportioned vehicle vehicles over 26000 pounds that cross state lines contact the Department of Motor Vehicles Motor Carrier Services.

This is the total of state county and city sales tax rates. Motor Vehicle Fee is based upon the value weight and use of the vehicle and is adjusted as the vehicle ages. After 1 is retained by the County Treasurer the distribution of funds collected.

When a motor vehicle dealer. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022. Early payments for the current year taxes may be processed online starting December 1st with statements being.

You may now Register your Vehicle Online or Schedule an Appointment. Nebraska has a 55 sales tax and Douglas County collects an additional NA so the minimum sales tax rate in Douglas County is 55 not including any city or special district taxes. The minimum combined 2022 sales tax rate for Douglas Nebraska is.

Prior to registering a vehicle in Colorado Proof of Insurance for the vehicle you are registering is required. Sales and Use Tax Regulation 1-02202 through 1-02204. The lessor must issue a Nebraska SalesUse Tax and Tire Fee Statement for Motor Vehicle and Trailer Sales Form 6.

The current total local sales tax rate in Douglas County NE is 5500. Real Property Tax Search Please enter either Address info or a Parcel Number. 2915 NORTH 160TH STREET OMAHA NE 68116 DOUGLAS Sales Tax.

LINCOLN Douglas County Treasurer and State DMV Driver Licensing customers will notice some changes the next time they visit the office at 2910 N.

How To Figure License Plate Cost In Nebraska Loup City

Renew Vehicle Registration License Plates Douglas County

/cloudfront-us-east-1.images.arcpublishing.com/gray/QJNBDO36B5K6JBWFVEM56S5IOU.jpg)

Supply Chain And Programming Issues Impact Douglas Co Property Tax Statements

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Douglas County Treasurer S Office Facebook

Vehicle And Boat Registration Renewal Nebraska Dmv

Sales Tax On Cars And Vehicles In Nebraska

Douglas County Treasurer Some Property Tax Statements Have Not Been Mailed

Motor Vehicles Douglas County Treasurer

![]()

1 Douglas County Omaha Nebraska Department Of Motor Vehicles

Douglas County Nebraska Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Nebraska Sales Tax Small Business Guide Truic

Motor Vehicles Douglas County Treasurer

Motor Vehicles Douglas County Treasurer

Douglas County Treasurer S Office Facebook

/cloudfront-us-east-1.images.arcpublishing.com/gray/QJNBDO36B5K6JBWFVEM56S5IOU.jpg)

Supply Chain And Programming Issues Impact Douglas Co Property Tax Statements

How The Nebraska Wheel Tax Works Woodhouse Nissan

How Healthy Is Burt County Nebraska Us News Healthiest Communities